By Ned Oliver

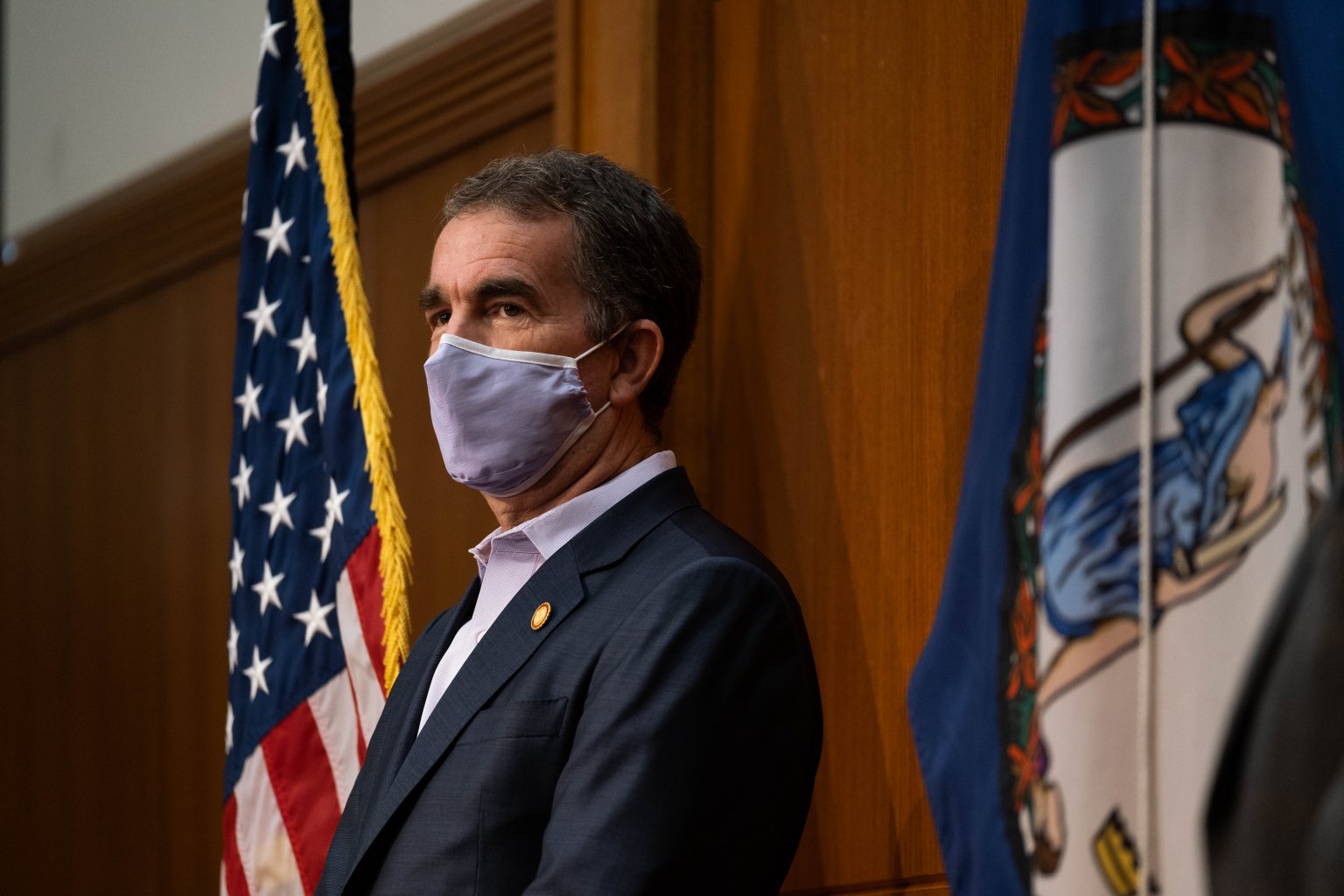

(VM) – Businesses that had been facing a hefty increase in payroll taxes in 2021 tied to widespread layoffs amid the pandemic will get at least a year-long reprieve, Gov. Ralph Northam’s administration announced just before Christmas.

“This will prevent Virginia’s struggling businesses from having to devote critical resources to higher state payroll taxes,” Northam’s office said in a news release.

Northam’s administration calculated that some of the hardest hit businesses in the state would have had to pay as much as $600-per-employee next year in additional taxes if the state had not taken the step.

The potential increase stemmed from the way states fund their unemployment insurance programs, charging employers responsible for layoffs that lead to unemployment insurance claims more than businesses that retain workers.

Northam’s Chief Workforce Adviser Megan Healy called that approach untenable in a year in which many of the businesses that would have faced the steepest increase are the ones still struggling to stay afloat as the pandemic drags on, namely in the restaurant, lodging and retail sectors.

“This is not the time to increase taxes on businesses,” she said.

Still, employers will see a modest increase in two other payroll taxes tied to unemployment insurance that Healy said the state has no control over. She said the increases will add up to an average of $30 per year per employee.

Healy said letters are going out to employers outlining the precise tax rates they’ll be assessed next year.

Virginia’s unemployment insurance trust fund began the year with a balance of $1.5 billion. By October, the fund had been exhausted and the Virginia Employment Commission projected it would close out 2020 with a record $750 million deficit, with the fund only kept afloat by loans from the federal government.

Healy said the state is still discussing how to pay back those loans without burdening already struggling businesses. The problem is not unique to Virginia — 20 states have borrowed a combined $44 billion, according to the Department of Labor —and officials had been holding out hope for federal action. Healy said one potential solution would be to make the loans interest free or at least extend the timetable for paying them back.

But at this point, she said it’s unclear whether relief will be forthcoming. “We’re waiting for the Biden administration to come in to be honest,” she said.

During the special legislative session that concluded in November, Northam and lawmakers dedicated $210 million in federal CARES Act funding to help cover the growing shortfall.

Northam is proposing amending the budget again when lawmakers reconvene next month to allocate another $7.5 million, which his administration said would cover interest on federal cash advances to date.

Northam’s budget also includes $10 million to maintain current staffing levels, which the state has dramatically ramped up to help handle the more than 5 million jobless claims received to date. Like many states, Virginia has struggled to keep pace with the surge in applications and some applicants have been left waiting months for the state to review their claims.

Healy said the state also plans to begin work to revamp the 1980s technology it relies on to process and pay claims — a step that had been scheduled to begin when the pandemic started but was put on hold.

Healy said when the upgraded system goes online, it should help relieve stress on call centers, which have been the only source of detailed information on stalled claims and the status of benefits.